In the world of finance, the changing winds are rarely subtle. They don’t gently shift the sands; rather, they tend to lift the entire dune and deposit it elsewhere. The recent move by the U.S. government to reclaim physical currency, as the dollar sinks in value, is one such sandstorm. It’s an intriguing policy decision that carries the weight of decades of monetary history and raises critical questions about the future of the world’s dominant currency.

I. The Dollar’s Fall

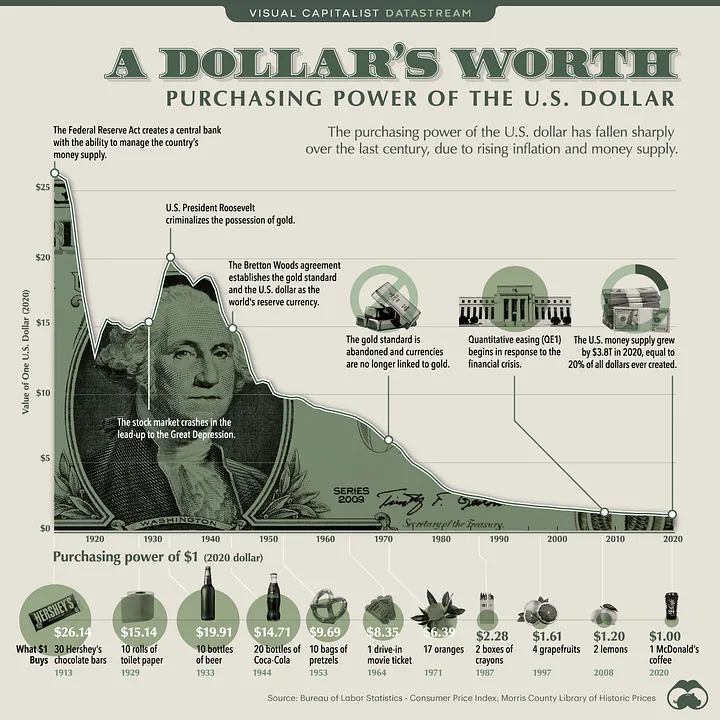

The U.S. dollar, like any currency, is a measure of trust. It’s a promise from the U.S. government that it will uphold its value. But recently, that promise has started to waver. A confluence of factors, ranging from persistent inflation to surging public debt, has undermined faith in the greenback.

The numbers tell a harrowing tale. The Consumer Price Index (CPI), a common measure of inflation, has been on a steep rise, surpassing the Federal Reserve’s comfort zone. Meanwhile, the U.S. debt-to-GDP ratio, a key barometer of fiscal health, has reached post-World War II highs. The dollar’s position as the world’s reserve currency is being questioned, creating an economic maelstrom that threatens to unseat the almighty dollar from its throne.

II. The Unraveling Threads of Trust

Trust, once lost, is hard to regain. The erosion of trust in the dollar is an issue that extends far beyond America’s borders. Around 60% of global reserves are held in dollars, and a significant portion of international trade is conducted in the currency. As faith in the dollar wanes, the world’s financial architecture, painstakingly built over decades, is in jeopardy.

In this context, the U.S. government’s move to reclaim physical currency can be seen as a bid to restore trust. It’s an attempt to assert control in a situation where the levers of monetary policy seem to be slipping from their grasp. It’s a classic case of taking a step back to leap forward.

III. The Return to Tangible Value

At its core, the decision to reclaim physical currency is an attempt to tether the dollar’s value to something tangible. Digital currency, while convenient, is ephemeral. It’s a series of zeroes and ones, subject to the whims of algorithms and digital platforms. Physical currency, on the other hand, is tangible, carrying a sense of permanence that digital forms lack.

It’s a bid to return to the gold standard, albeit in a different form. The gold standard, which tied the dollar’s value to a fixed quantity of gold, was abandoned in 1971. But the principle underlying it — that a currency’s value should be anchored to something physical — remains relevant.

IV. The Implications of Currency Reclamation

Currency reclamation is not a simple process. It involves persuading citizens to return their physical currency, which requires a combination of incentives and regulatory measures. It’s a delicate balancing act, designed to avoid spooking the markets while asserting the government’s control over monetary policy.

The implications are far-reaching. If the move is successful, it could shore up trust in the dollar, stabilizing its value. On the other hand, if it fails, it could exacerbate the dollar’s decline, deepening the crisis. It’s a high-stakes gamble, with the future of the world’s dominant currency hanging in the balance.

V. The Future of the Dollar

The move to reclaim physical currency is a clear signal that the U.S. government is concerned about the dollar’s slide. It’s an indication of a deeper reassessment of the nature of currency, trust, and value in the digital age.

The question, then, is whether this approach will work. Will the U.S. government succeed in its bid to restore faith in the dollar? The answer will depend on a multitude of factors.

Firstly, the economic fundamentals need to improve. Inflation needs to be tamed, and the debt-to-GDP ratio needs to come down. Without these improvements, any attempt to restore trust in the dollar will likely be futile.

Secondly, the U.S. government needs to strike the right balance in its reclamation strategy. It needs to incentivize citizens to return their physical currency without causing panic or undermining confidence. This is easier said than done. It requires a careful blend of communication, regulation, and monetary incentives.

Finally, the international community plays a crucial role. The dollar’s status as the world’s reserve currency means that its fate is not solely in America’s hands. Other nations, particularly those with large dollar reserves, have a vested interest in the dollar’s stability. Their actions will significantly influence the outcome of the U.S. government’s currency reclamation efforts.

VI. An Unprecedented Monetary Experiment

The U.S. government’s move to reclaim physical currency is unprecedented. It’s a bold experiment in monetary policy that will be watched closely by economists, policymakers, and investors around the world.

Whether it will succeed remains to be seen. But one thing is clear: the U.S. government is not willing to sit back and watch the dollar’s value erode. It’s prepared to take bold, unconventional measures to defend the world’s dominant currency.

This move, then, is more than just an attempt to stem the dollar’s decline. It’s a statement of intent, a declaration that the U.S. is ready to fight for the dollar’s status as the world’s reserve currency.

VII. Conclusion

In the realm of finance, the winds of change are often swift and brutal. The U.S. government’s move to reclaim physical currency in the face of the dollar’s devaluation is a clear example of this. It’s a stark reminder of the inherent volatility of our modern financial system, and a testament to the lengths that governments will go to in order to preserve economic stability.

As we watch this monetary saga unfold, let’s remember that it’s not just about numbers on a screen or pieces of paper in a wallet. It’s about trust, value, and the fundamental principles that underpin our economic system. As the U.S. government grapples with the dollar crisis, these are the issues that will shape the future of the world’s dominant currency.

In the end, the success of the U.S. government’s efforts to reclaim physical currency will hinge on its ability to restore faith in the dollar. The outcome of this experiment will tell us a lot about the future of currency, trust, and value in the digital age. It’s a story worth watching closely, a tale of money, power, and the complex dance of global finance.